Walnut Creek Business Formation Attorney Thomas S. Carter provides strategic legal counsel to entrepreneurs and new businesses throughout the East

Bay. From initial concept to operational launch, Mr. Carter assists clients in navigating entity selection, corporate

structuring, and regulatory compliance with an emphasis on long-term stability and growth. His services are designed to

establish a solid legal foundation for new businesses, and help position startups for sustainable success in competitive

markets.

If your venture requires thoughtful legal planning during formation, contact The Law Office of Thomas S. Carter at (925)

262-9220 to schedule a complimentary consultation.

Business Entity Selection | Identifying the Right Structure

Corporations offer distinct legal protection for owners while allowing for flexible capitalization and long-term operational

continuity. Mr. Carter guides clients in selecting between C Corporations and S Corporations based on ownership

objectives, tax considerations, and future investment plans. C Corporations are well-suited for ventures anticipating venture capital funding, multiple

investor classes, or stock incentive programs. S Corporations provide pass-through taxation while preserving liability protections and corporate

governance structures that build trust with investors, customers, and partners. Corporate governance plans often include bylaws, shareholder

agreements, and board protocols that promote operational clarity and protect shareholder interests.

LLCs offer a combination of liability protection and flexible taxation, making them a common choice for new ventures seeking operational simplicity.

Single-member LLCs provide straightforward tax reporting while limiting personal liability. Multi-member LLCs accommodate more complex ownership

arrangements, including customized profit allocations and management structures outlined in detailed operating agreements. Professional LLCs are

available for licensed practitioners who must meet regulatory standards while maintaining limited liability protections.

General partnerships and limited partnerships provide simplified operational structures but require thoughtful planning to address liability exposure and

partner authority. Joint ventures create a legal framework for collaboration on specific projects or market expansion opportunities. Mr. Carter assists in

developing partnership agreements that clarify profit-sharing arrangements, decision-making authority, and exit strategies, ensuring that all parties are

aligned and protected.

Corporate Formation Process | Establishing Your Business Entity

Initial Formation and Documentation

•

Articles of incorporation or organization filed with the Secretary of State

•

Tax identification number applications at the federal and state levels

•

Designation of a registered agent and business address

•

Development of corporate bylaws or LLC operating agreements

•

Shareholder or member agreements to establish ownership terms

•

Board resolutions and documentation of organizational meetings

Regulatory Compliance and Licensing

•

Business license applications and professional permits

•

Industry-specific regulatory approvals

•

Employment compliance including classification of workers

•

Tax registrations for sales, payroll, and other applicable taxes

•

Review of insurance coverage for operational risks

•

Intellectual property protection including trademarks and copyrights

Banking and Financial Systems

•

Establishment of business bank accounts

•

Preparation for business credit and loan applications

•

Implementation of accounting systems and financial controls

•

Setup of financial reporting tools to ensure regulatory compliance

•

Investment account formation and securities law analysis

•

Payment processing and merchant service arrangements

Strategic New Business & Startup Planning | Careful Planning Supports Growth

Establishing the correct business entity creates a legal shield between personal and business assets. Mr. Carter assists clients in designing corporate

structures that protect personal wealth from creditor claims and litigation risks. Comprehensive planning also involves insurance evaluation, indemnity

agreements, and risk management procedures that provide additional layers of protection.

Entity selection can significantly impact tax obligations and cash flow management. Mr. Carter works with clients to identify structures that align with

financial objectives, whether through pass-through taxation or corporate strategies that maximize deductions, credits, and loss utilization. International

operations may also require specialized tax planning for compliance with foreign regulations.

Positioning a company for investment requires foresight and precision. Mr. Carter helps clients develop structures that attract investors while

safeguarding control and limiting liability. He advises on stock plans, equity incentive arrangements, and securities compliance to facilitate capital raises. In

addition, he assists in preparing for future exit strategies, such as acquisitions or public offerings.

Ongoing Corporate Compliance and Growth Planning

Maintaining Legal Protections Beyond Formation

Annual Filings and Regulatory Obligations

To preserve legal protections, businesses must maintain good standing through annual reports, franchise taxes, and registered agent renewals. Corporate

formalities such as shareholder meetings and accurate recordkeeping are essential to demonstrate legal separation between business and personal

activities. Mr. Carter assists in navigating regulatory changes, tax law updates, and industry-specific reporting requirements.

Operational Policies and Documentation

Operational success depends on consistent procedures and clear documentation. Mr. Carter helps clients develop internal policies such as employee

guidelines, safety procedures, and compliance manuals. He also prepares business contracts that define relationships with vendors, customers, and

partners, ensuring legal protection and enforceability. Additional services include intellectual property agreements, confidentiality policies, and

competitive protection measures.

Planning for Expansion and Strategic Development

Businesses considering growth through new locations, acquisitions, or market entry require legal guidance. Business Formation Lawyer Thomas Carter

provides counsel on the legal aspects of expansion, including mergers, acquisitions, and financing arrangements, working alongside his business

transactions practice when appropriate. He also advises on workforce-related policies in collaboration with the firm’s employer defense services to

ensure compliance as employee headcounts increase. Succession planning and exit strategies are integrated to support long-term business continuity.

Industry-Specific Business Formation Considerations

Professionals such as attorneys, physicians, accountants, and consultants often require specialized entity structures. Mr. Carter advises on forming

professional corporations and LLCs that comply with licensing boards and ethical requirements. His services also cover liability management, insurance

planning, and compliance with continuing education mandates.

Startups in the technology sector require careful handling of intellectual property, licensing agreements, and data protection. Mr. Carter assists with patent

filings, trademark registrations, and confidentiality protocols that support competitive positioning. He also advises on venture capital readiness, equity

arrangements, and governance procedures that prepare companies for external investment.

Manufacturers and distributors face unique legal challenges related to regulatory compliance, product liability, and international trade. Mr. Carter works

with clients to address supply chain agreements, distribution networks, and environmental requirements. He also provides legal support for international

expansion, including export controls, investment structures, and global tax planning.

Call (925) 262-9220

Experienced & Knowledgeable Representation Tailored to Your Unique Business

Serving Businesses in the East Bay and Tri-Valley area

with Knowledgeable, Personalized Legal Guidance

Walnut Creek Business Formation | Startup Attorney Thomas Carter

Contact Business Formation Attorney Thomas S. Carter

Whether your business involves professional services, technology development, or other industries, Attorney Thomas S. Carter delivers comprehensive

legal guidance to support a strong start and sustained growth. His business-focused approach ensures that your legal structure supports both immediate

goals and future opportunities. Call (925) 262-9220 or complete our Case Evaluation Form to schedule a confidential consultation.

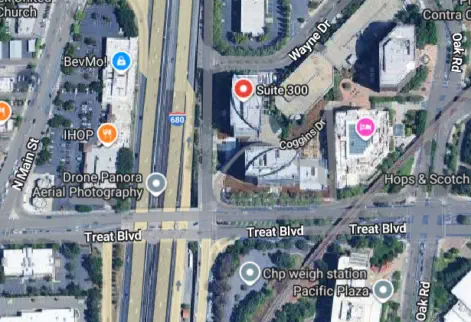

The Law Offices of Thomas S. Carter, Inc.

2950 Buskirk Ave. Suite 300

Walnut Creek, CA 94597

Phone: (925) 262-9220 email: tom@tscarterlaw.com

Disclaimer:

The information contained herein is for information purposes only and should not be construed as legal advice. You should not

act or fail to act based on the information on this website. The content contains general information only, and may not reflect

recent changes to the law. All cases differ. Please contact an attorney in your area to get legal advice as it pertains to your case.

© Copyright - The Law Office of Thomas S. Carter

Walnut Creek Business Formation |

Startup Attorney Thomas Carter

Walnut Creek Business Formation

Attorney Thomas S. Carter provides

strategic legal counsel to entrepreneurs

and new businesses throughout the East

Bay. From initial concept to operational

launch, Mr. Carter assists clients in

navigating entity selection, corporate

structuring, and regulatory compliance

with an emphasis on long-term stability

and growth. His services are designed to

establish a solid legal foundation for

new businesses, and help position

startups for sustainable success in

competitive markets.

If your venture requires thoughtful legal

planning during formation, contact The

Law Office of Thomas S. Carter at (925)

262-9220 to schedule a complimentary

consultation.

Business Entity Selection |

Identifying the Right Structure

Corporations offer distinct legal

protection for owners while allowing for

flexible capitalization and long-term

operational continuity. Mr. Carter guides

clients in selecting between C

Corporations and S Corporations based

on ownership objectives, tax

considerations, and future investment

plans. C Corporations are well-suited for

ventures anticipating venture capital

funding, multiple investor classes, or

stock incentive programs. S

Corporations provide pass-through

taxation while preserving liability

protections and corporate governance

structures that build trust with investors,

customers, and partners. Corporate

governance plans often include bylaws,

shareholder agreements, and board

protocols that promote operational

clarity and protect shareholder interests.

LLCs offer a combination of liability

protection and flexible taxation, making

them a common choice for new

ventures seeking operational simplicity.

Single-member LLCs provide

straightforward tax reporting while

limiting personal liability. Multi-member

LLCs accommodate more complex

ownership arrangements, including

customized profit allocations and

management structures outlined in

detailed operating agreements.

Professional LLCs are available for

licensed practitioners who must meet

regulatory standards while maintaining

limited liability protections.

General partnerships and limited

partnerships provide simplified

operational structures but require

thoughtful planning to address liability

exposure and partner authority. Joint

ventures create a legal framework for

collaboration on specific projects or

market expansion opportunities. Mr.

Carter assists in developing partnership

agreements that clarify profit-sharing

arrangements, decision-making

authority, and exit strategies, ensuring

that all parties are aligned and

protected.

Corporate Formation Process |

Establishing Your Business Entity

Initial Formation and

Documentation

•

Articles of incorporation or

organization filed with the Secretary

of State

•

Tax identification number

applications at the federal and state

levels

•

Designation of a registered agent and

business address

•

Development of corporate bylaws or

LLC operating agreements

•

Shareholder or member agreements

to establish ownership terms

•

Board resolutions and

documentation of organizational

meetings

Regulatory Compliance and

Licensing

•

Business license applications and

professional permits

•

Industry-specific regulatory approvals

•

Employment compliance including

classification of workers

•

Tax registrations for sales, payroll, and

other applicable taxes

•

Review of insurance coverage for

operational risks

•

Intellectual property protection

including trademarks and copyrights

Banking and Financial Systems

•

Establishment of business bank

accounts

•

Preparation for business credit and

loan applications

•

Implementation of accounting

systems and financial controls

•

Setup of financial reporting tools to

ensure regulatory compliance

•

Investment account formation and

securities law analysis

•

Payment processing and merchant

service arrangements

Strategic New Business & Startup

Planning | Careful Planning

Supports Growth

Establishing the correct business entity

creates a legal shield between personal

and business assets. Mr. Carter assists

clients in designing corporate structures

that protect personal wealth from

creditor claims and litigation risks.

Comprehensive planning also involves

insurance evaluation, indemnity

agreements, and risk management

procedures that provide additional

layers of protection.

Entity selection can significantly impact

tax obligations and cash flow

management. Mr. Carter works with

clients to identify structures that align

with financial objectives, whether

through pass-through taxation or

corporate strategies that maximize

deductions, credits, and loss utilization.

International operations may also

require specialized tax planning for

compliance with foreign regulations.

Positioning a company for investment

requires foresight and precision. Mr.

Carter helps clients develop structures

that attract investors while safeguarding

control and limiting liability. He advises

on stock plans, equity incentive

arrangements, and securities

compliance to facilitate capital raises. In

addition, he assists in preparing for

future exit strategies, such as

acquisitions or public offerings.

Ongoing Corporate Compliance

and Growth Planning

Maintaining Legal Protections

Beyond Formation

Annual Filings and Regulatory

Obligations

To preserve legal protections, businesses

must maintain good standing through

annual reports, franchise taxes, and

registered agent renewals. Corporate

formalities such as shareholder

meetings and accurate recordkeeping

are essential to demonstrate legal

separation between business and

personal activities. Mr. Carter assists in

navigating regulatory changes, tax law

updates, and industry-specific reporting

requirements.

Operational Policies and

Documentation

Operational success depends on

consistent procedures and clear

documentation. Mr. Carter helps clients

develop internal policies such as

employee guidelines, safety procedures,

and compliance manuals. He also

prepares business contracts that define

relationships with vendors, customers,

and partners, ensuring legal protection

and enforceability. Additional services

include intellectual property

agreements, confidentiality policies, and

competitive protection measures.

Planning for Expansion and

Strategic Development

Businesses considering growth through

new locations, acquisitions, or market

entry require legal guidance. Business

Formation Lawyer Thomas Carter

provides counsel on the legal aspects of

expansion, including mergers,

acquisitions, and financing

arrangements, working alongside his

business transactions practice when

appropriate. He also advises on

workforce-related policies in

collaboration with the firm’s employer

defense services to ensure compliance

as employee headcounts increase.

Succession planning and exit strategies

are integrated to support long-term

business continuity.

Industry-Specific Business

Formation Considerations

Professionals such as attorneys,

physicians, accountants, and consultants

often require specialized entity

structures. Mr. Carter advises on

forming professional corporations and

LLCs that comply with licensing boards

and ethical requirements. His services

also cover liability management,

insurance planning, and compliance with

continuing education mandates.

Startups in the technology sector require

careful handling of intellectual property,

licensing agreements, and data

protection. Mr. Carter assists with patent

filings, trademark registrations, and

confidentiality protocols that support

competitive positioning. He also advises

on venture capital readiness, equity

arrangements, and governance

procedures that prepare companies for

external investment.

Manufacturers and distributors face

unique legal challenges related to

regulatory compliance, product liability,

and international trade. Mr. Carter

works with clients to address supply

chain agreements, distribution networks,

and environmental requirements. He

also provides legal support for

international expansion, including

export controls, investment structures,

and global tax planning.

Contact Business Formation

Attorney Thomas S. Carter

Whether your business involves

professional services, technology

development, or other industries, Attorney

Thomas S. Carter delivers comprehensive

legal guidance to support a strong start and

sustained growth. His business-focused

approach ensures that your legal structure

supports both immediate goals and future

opportunities. Call (925) 262-9220 or

complete our Case Evaluation Form to

schedule a confidential consultation.

Walnut Creek Business Formation

| Startup Attorney Thomas Carter

Disclaimer:

The information contained herein is for information

purposes only and should not be construed as legal

advice. You should not act or fail to act based on the

information on this website. The content contains general

information only, and may not reflect recent changes to

the law. All cases differ. Please contact an attorney in

your area to get legal advice as it pertains to your case.

© Copyright - The Law Office of Thomas S. Carter

1 2 3 4 5 6 7 8

Experienced & Knowledgeable

Representation Tailored

to Your Unique Business

The Law

Offices of

Thomas S. Carter,

Incorporated

Serving Businesses

in the East Bay and Tri-Valley area